Jubilee ‘22: Debt Relief Now!

I recently watched and re-watched the beautifully illustrated six-minute video called Your Debt is Someone Else’s Asset, detailing the crisis of American debt burden and the history of debt relief. Offering plenty of facts and figures, the video’s proposal of granting relief to the average U.S. citizen suffering debt burden is revealed as not only achievable, but economically stabilizing.

The revolutionary little piece narrated by Astra Taylor and illustrated by Molly Crabapple, released in late 2021, caused me to look back at my own experience of the shifts in debt burden over time. I grew up in California, where the University of California system was created in 1868, declaring “admission and tuition shall be free to all residents of the state.” The California State and community-college systems followed suit, and all college education was tuition-free until the mid-1960s, when Governor Ronald Reagan pushed for instituting charges to curb the UC Berkeley campus protesters—my brother among them—who were clamoring for free speech and opposing the Vietnam War.

When I attended UCLA in 1960, the fee was around $69 a semester! At age 18, with a part time job in the UCLA library and a bed in a friend-of-a-friend’s living room, I notified my parents that I could survive without their financial help.

In contrast, today’s youth are collectively saddled with $1.8 trillion dollars of student debt!

Those struggling to cancel student debt and demanding free college education—such as the Debt Collective—are not promoting a new, radical idea. Countless numbers of our lawmakers, for example, were educated at free colleges. And more than a dozen countries in Europe and elsewhere offer their citizens free college education—some even extend the offer to international students—providing working-class students access to professions otherwise financially out of reach of their U.S. counterparts.

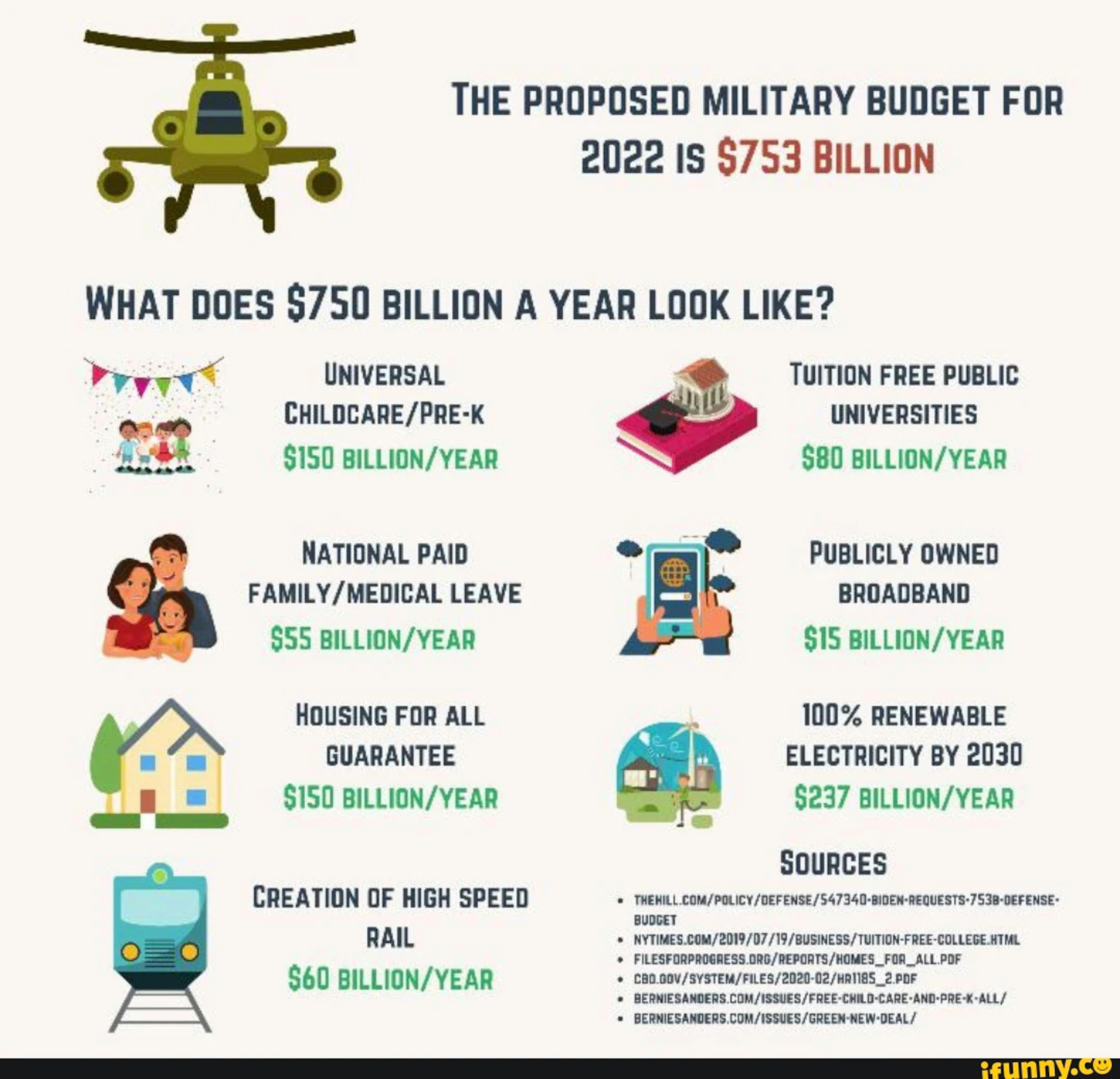

According to the most recent Department of Education data, eliminating tuition at public colleges and universities would cost about $79 billion a year, with public and private benefits greatly exceeding the costs. Yet, at the moment, only 37 percent of Americans between the ages of 25 and 29 have a four-year degree—with a large gap in access to Blacks and Hispanics.

A July, 2019 New York Times article titled “Tuition-free College Could Cost Less Than You Think” suggests that what we already spend on programs to nudge students into college could go a long way toward offsetting that $79 billion.

“First, about $37 billion of the federal money went toward tuition tax credits and other tax benefits, which disproportionately helped wealthier families…some of this aid could be repurposed to allow for tuition-free public institutions, which would help poorer people more. Second, $41 billion in federal spending went toward aid for low-income students and military veterans, while $13 billion subsidized interest payments on student loans while students were enrolled in college.”

While working class folks are held accountable for our debts, and one late payment can disrupt our credit, the wealthy regularly get bailed out and walk away from their debts. The banks that crashed the economy in 2008 through predatory loans to low-income borrowers were rewarded with a bailout, while millions of families, including many African American, lost their homes and nest eggs. I witnessed former Latinx students of mine and a gifted carpenter who built a porch for me get devastated by foreclosure.

From 2007-2009, during the Great Recession, the Feds loaned or guaranteed the banks on the brink of disaster 7.7 trillion dollars! The nation’s biggest banks borrowed our taxpayer money—virtually interest free—and made $13 billion on our backs. And banks saw their assets grow 39% between 2006 and 2011!

In 2008, Congress authorized the Troubled Asset Relief Program, or TARP, lending or directly investing $426 billion in taxpayer money to major banks and corporations. While Black and Brown families lost 50% of their collective wealth, 20 percent of TARP funds—$80 billion dollars—went to bail out General Motors and Chrysler!

In addressing Covid challenges, the Feds once again spent hundreds of millions of dollars buying up bad corporate debt from entities that included Walmart and Exon. (In 2020, Walmart generated revenues of $141.67 billion in the fourth quarter and Exxon’s revenue jumped 60%!)

Donald Trump came to the Oval Office sporting a string of corporate bankruptcies, while a 2005 bankruptcy bill heavily supported by Joe Biden, then-Senator from Delaware (the credit card capital of the world), made filing for bankruptcy more difficult for Americans.

Meanwhile US spending on the military is at an all-time high, with the Biden administration increasing the defense budget to $768 billion in 2021 despite the end of the Afghanistan war—funds that could augment debt relief with much needed life-sustaining programs: universal childcare, family/medical leave, a national Homes Guarantee, nationwide high speed rail, tuition-free public universities, publicly owned broadband, and 100% solar electricity by 2030.

Noting there is ample historical precedent, Your Debt is Someone Else’s Asset asserts our right to use our tax dollars to institute a “Jubilee” to absolve working class debt and help restore the balance of power. First mentioned in the Bible in Leviticus 25, the concept of jubilee is woven throughout our history. A debtor’s riot pushed ancient Athens toward democracy through reforms known as “shaking off of burdens” that included debt absolution. In ancient Rome, the world’s first general strike was mounted to address unjust debt.

For the past few years, powerful news outlets like the New York Times, The Nation, and The New Republic have been discussing debt relief. Abolishing medical debt, deferred house and rent payments, and student loans would free up money, create jobs, and stimulate the economy. Cancelling student debt alone would boost the economy by $108 billion a year, creating a million and a half jobs and narrowing the racial wealth gap.

Let we the people proclaim 2022 a Jubilee year and demand that our lawmakers use our tax money to shake off the cloud of debt from the American people.

Actively engaged in her beloved Santa Cruz Community for five decades, Sheila Carrillo began writing and publishing political commentary in 2016 after participating in a fact-finding delegation to Israel/Palestine as a Jew who had been shocked and outraged when even the most progressive Santa Cruz Rabbis vehemently condemned a local BDS conference. Sheila Carrillo is also a member of DSA Santa Cruz.